What is Air Departure Tax?

Powers to levy tax on air travel (known in the UK as Air Passenger Duty) were devolved to the Scottish Parliament in 2016. Following on from the SNP’s 2015 manifesto promise, the Scottish Government plans to reduce the tax by 50%, with a view to abolishing it altogether ‘when resources allow’.

On 20 June, the Scottish Parliament voted to create the Air Departure Tax (Scotland) Act, with 108 MSPs voting in favour, and 11 voting against including the Scottish Green MSPs. This law contains no details about the rate at which ADT will be set at – it simply allows for Air Passenger Duty to be collected. The Scottish Government is now consulting on what rate ADT should be set at.

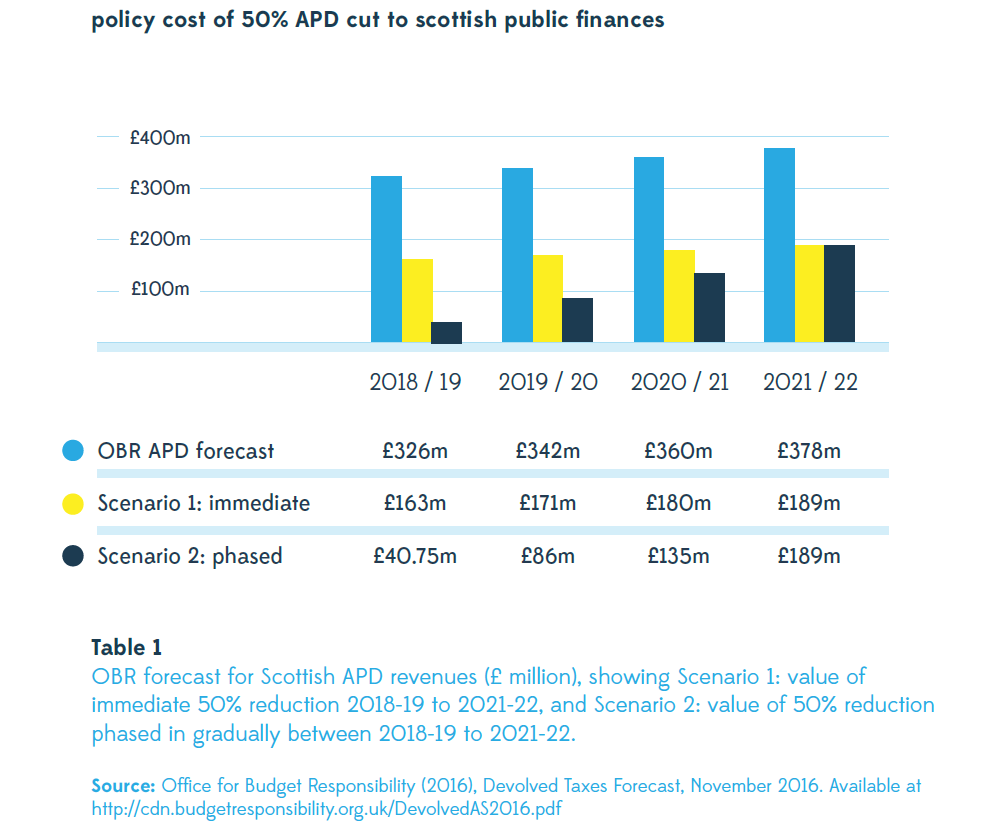

Unlike the Scottish Government, the Scottish Greens have done some research on who benefits from their planned cut. Any reduction to ADT is an overwhelmingly fiscally regressive tax cut – it would be a tax giveaway for Scotland’s wealthiest households and corporations. Next year alone, a 50% reduction in ADT would cost the Scottish Government £163m. By the end of this parliament in 2021/22, Scotland’s budget will have lost £703m from a 50% ADT reduction.

Cutting ADT tax in half is expected to increase emissions from Scottish aviation by around 4%, undermining Scotland’s climate commitments and its status as a world leader in driving down emissions.

Isn’t flying better for the environment than driving long distances?

No. Air travel is the most polluting mode of transport by far – the amount of carbon emissions generated is significantly higher than any other common consumer behaviour.

An example: driving the 400miles from Glasgow to London Heathrow will emit 0.13 tonnes co2e for a medium sized petrol car, or 0.03 tonnes co2e per person with four people in the car. Flying the same journey would produce six times that much, 0.20 tonnes co2e per person (assuming the plane was completely full). Driving the 1,000 miles from Glasgow to Berlin would emit 0.09 tonnes co2e per person in a full car. The equivalent figure for flying in a full aircraft is 0.25 tonnes co2e.

These figures were produced using the UK Government’s 2016 greenhouse gas conversion factors though the website www.co2balance.com

People travelling to or from Highlands and Islands are often reliant on air travel – this will be helpful for them.

People travelling to and from the Highlands and Islands will actually lose out from an ADT cut - flights from airports in this region are already exempt from paying Air Passenger Duty. An ADT cut across the whole of Scotland would end the special treatment that’s meant to recognise the specific circumstances of the Highlands and Islands. People living in Scotland’s central belt will be the main beneficiaries of an ADT reduction, but people everywhere will lose out on the public services funded by the tax revenue.

Cutting ADT will increase tourism to Scotland and will be good for the economy.

Actually, research published by the Scottish Greens demonstrates that even if cutting ADT does increase inbound tourism, it it highly likely to increase outbound tourism, which will cost our economy more than it gains. We already have a ‘tourism deficit’ of £21bn across the UK in 2016, because UK residents spent more on holidays overseas than overseas residents spent on visits to the UK (ONS, 2017). Scottish businesses (hotels, restaurants, pubs, tourist attractions) stand to lose out from this tax cut.

Cutting ADT will create jobs and investment.

On the contrary, evidence about an ADT cut leading to an even greater imbalance between inbound and outbound tourist numbers in Scotland means that some people working in tourist industries in Scotland may actually lose their jobs.

At a time of economic uncertainty, the Scottish Government is set to lose £163m next year alone if it introduces a 50% cut to ADT. By the end of this parliamentary session (2021), an 50% reduction to ADT will have cost the Scottish budget £703m. Add to this, the UK aviation lobby has a track record of making exaggerated claims for jobs and growth; investment and job creation as a result of an ADT cut does not look likely.

Cutting ADT will give Scotland a competitive advantage.

The devolution of aviation tax powers to Holyrood represented a strategic opportunity for the UK aviation lobby to pursue their long-standing zero tax agenda. Long term observers of the UK’s aviation industry will be aware that vigorous lobbying against APD has been underway since the tax was introduced, but up until now has fallen largely on deaf ears at HMRC. Tax economists at the Treasury know that taxing air travel is efficient and progressive, because the price elasticity of demand is low and the tax is mainly collected from rich households. The UK’s aviation industry has finally managed to get hold of a thread which, when pulled hard enough, is capable of unravelling the fiscal framework for air travel right across the British Isles.

The SNP’s commitment has fired the starting gun for a race to the bottom on air passenger taxes in the UK. Any competitive advantage conferred on Scotland’s airports from a reduction in these taxes will be short lived.

But not all frequent flyers are rich.

Almost all frequent flyers are rich. People who report flying at least four times per month, are predominantly in the richest 10% of Scottish households. These people are earning between £45,210 and £765,400, and they stand to gain over 40 times as much from the tax cut as regular travellers, saving on average £850 in 2018/19 after a 50% cut in air passenger tax rates. In any given year, over half of Scots do not fly at all and will therefore be ‘losers’ if ADT is cut.

Cutting ADT will make flights cheaper, so not only the rich can travel more.

The aviation industry has made no guarantees about reducing ticket prices if ADT is reduced. And even if they had, direct benefits from an ADT cut are heavily skewed towards the wealthiest sections of society – an ADT reduction will simply make it easier for the rich to travel even more than they already do. 8.3% of the total tax break pie - £13.5m in 2018/19 - will go to leisure passengers in the richest 10% of Scottish households, while only 2.4% (£4m) goes to the poorest 10%. 70% of those in the poorest income decile (those earning less than £8,292) will derive no direct benefit from an ADT cut.

If we are seriously concerned about making travel accessible for all, we need to address high fares and poor services on buses and trains that most people catch every single day. We need to connect up areas with poor transport links, increase spending on active travel (walking, cycling), and make streets safer and accessible for everyone. If the Scottish Government forfeits £703m to the aviation industry during this parliament, this important work will be difficult to achieve.

Don’t you want to help hard-working families go on a holiday abroad?

Cutting ADT won’t do that. Since April 2016, children under the age of 16 flying on economy tickets pay no APD – they will therefore be ‘losers’ under the policy. Families travelling abroad on holiday represent a very small fraction of the beneficiaries of a cut to aviation taxes – only 6% of all international flights by UK residents are taken by children. Families will benefit from an ADT reduction only half as much as passengers on other types of journey.

Passengers flying on first or business class tickets or on luxury jets make up a very small proportion of all passengers, but will benefit disproportionately from a 50% cut in ADT. We estimate the average per journey saving for a passenger on a luxury jet is £54, while a first class passenger will save £20 and an economy class passenger just £8.

If ADT is cut by 50%, a family of two adults travelling economy with any number of children will save at most £16. Focusing on the benefits to families with children is highly misleading.

Cutting ADT was in the SNP’s manifesto and people voted for it.

The SNP did not get a majority in the most recent Scottish Parliament elections - they do not have a mandate to implement all of their manifesto, and they need to work constructively with other parties in order to develop fair and sustainable policies and legislation.

Our current level of Air Passenger Duty is one of the highest in Europe – cutting ADT will put Scottish airports on an even footing with competitors.

Cutting ADT is completely out of step with what is happening in the rest of Europe, where governments are recognising the financial and environmental benefits of taxing aviation. Irish Minister for Finance, Michael Noonan, recently raised the prospect of reinstating the air travel tax, saying that the airline industry in Ireland is under-taxed. The German Parliament recently conducted a study which concluded that the net gain for the German government of an aviation tax was €800m – whilst the tax cost Germany €200m from lost flights, it earned Germany €1000m in tax revenues. They are keeping aviation tax.

The Swedish Government last year published an inquiry into introducing aviation tax, concluding that ‘Even if a tax on air travel is introduced, the total number of passengers departing from airports in Sweden can be expected to rise.’ Their current proposals are for an air travel tax act that will enter into force on 1 January 2018.

We can just try harder to reduce emissions elsewhere.

Nicola Sturgeon has sought to justify the intended consequences of an ADT cut - rising flight numbers and airport expansion - by saying: ‘any increase in emissions in one area, we must work harder in other areas to ensure that we drive down emissions overall’. But even at present rates, APD is not high enough to cover the environmental costs imposed on society by air travel, which is itself the most carbon intensive consumer behaviour by some margin. There is no way around it – we cannot meet our climate change targets whilst also overseeing an expansion in aviation.

Maybe we could just cut ADT for short haul flights, or long haul flights, or reduce it by less than 50%?

Tweaking an ADT reduction doesn’t change what it fundamentally is: a tax cut for wealthy frequent flyers and an already undertaxed aviation industry, which deprives the Scottish budget of significant resources, and which does so at the expense of our environment. Even at present rates, APD is not high enough to cover the environmental costs imposed on society by air travel, which is itself the most carbon intensive consumer behaviour by some margin – any ADT reduction, applied in any way, worsens this situation.

The plane will take off without me – so what’s the point in fighting this?

Tomorrow, a flight you choose not to get on will take off without you. But in the longer term, if we all change our behaviour and use modes of transport other than planes, lower demand will lead to fewer flights. So without you, the plane won’t take off. Climate change is one of the most serious threats facing the world, which governments and corporations are not addressing effectively – our future and our children’s future is at stake, so let’s do things better in Scotland.